Since the introduction of the Goods and Services Tax (GST) in India, businesses, especially small ones, have been navigating its complexities. Fortunately, the GST Composition Scheme offers a simpler alternative, tailored for smaller enterprises to manage their tax obligations more efficiently.

Understanding GST and Its Impact on Businesses

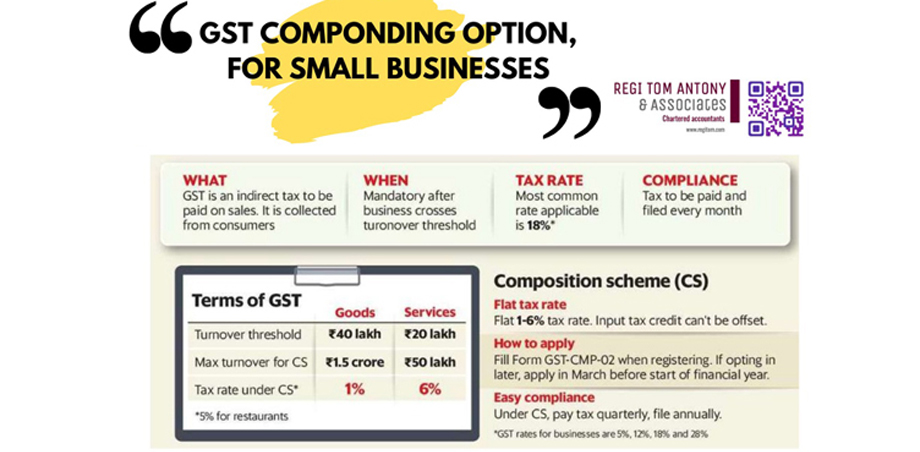

GST, launched on July 1, 2017, replaced various indirect taxes with a single tax. It is levied on the sale of goods and services, with businesses collecting it from customers. While GST is a tax on sales, income tax is levied on the net income or profits made from these sales.

Businesses exceeding certain turnover thresholds must register for GST. Currently, these thresholds are ₹20 lakh for service providers and ₹40 lakh for goods manufacturers and vendors. GST rates vary between 5%, 12%, 18%, and 28%, but the most common rate is 18%.

The Composition Scheme: Simplifying GST for Small Businesses

1. Scheme Overview:

The Composition Scheme under GST Law is an alternative method of tax payment designed for small businesses. It allows them to pay GST at a flat rate of 1-6% depending on the nature of the business, but without the benefit of claiming input tax credits.

2. Turnover and Tax Calculation:

Under this scheme, GST is calculated on total turnover, which includes all invoice amounts raised in a month, regardless of payment receipt. For service businesses, any advance received is also added to the turnover for that month.

3. Input Tax Credit:

Input tax credit refers to the GST paid on business-related expenses, which can usually be offset against the total GST liability. However, under the Composition Scheme, businesses forgo this benefit in exchange for a simpler and lower tax rate.

4. Applicability and Rates:

Services businesses, goods vendors, and restaurants are taxed at 6%, 1%, and 5%, respectively, under the scheme. The scheme is particularly beneficial for service businesses like freelancers and micro enterprises with minimal business expenses.

**5. Turnover Threshold for Eligibility:**

The scheme is available for service businesses with an annual turnover of up to ₹50 lakh. For goods businesses, the threshold is ₹1.5 crore. Beyond this, the regular GST rates apply.

6. Registration and Compliance:

Businesses can opt for the Composition Scheme at the time of GST registration. Existing GST taxpayers wishing to switch to this scheme must fill out Form GST-CMP-02 on the GST portal.

This scheme simplifies compliance by requiring quarterly tax payments and annual tax return filing, as opposed to the monthly requirements under regular GST.

Advantages of the Composition Scheme

1. Simplified Tax Rate and Compliance:

Businesses benefit from a flat tax rate, making tax calculations straightforward. The reduced compliance burden is particularly advantageous for small businesses with limited resources.

2. Improved Cash Flow:

A lower tax liability under the Composition Scheme can free up cash flow, which is crucial for small businesses' growth and sustainability.

Considerations Before Opting for the Composition Scheme

1. Input Tax Credit:

Businesses should evaluate the trade-off between paying a lower tax rate and forgoing the input tax credit. In some cases, the regular GST regime with input tax credit might be more beneficial.

2. Business-to-Business Transactions:

For businesses dealing primarily in B2B transactions, staying under the regular GST rates might be preferable as the input credit of 1% tax under the Composition Scheme is not claimable by business clients.

Conclusion

The GST Composition Scheme is an effective tool for small businesses in India to manage their tax obligations in a simpler and more cost-effective manner. By reducing the compliance burden and offering a lower tax rate, the scheme makes it easier for small businesses to focus on growth and development. However, it's important to carefully evaluate the specific needs and nature of the business before opting for this scheme. Consulting a tax professional can provide valuable insights and help make an informed decision.

25 Jan 2024

25 Jan 2024